W. Scott Simon

The Prefatory Note to the 1994 Uniform Prudent Investor Act states, in part: “The tradeoff in all investing between risk and return is identified as the fiduciary’s central consideration.” Think of this as the ground zero directive as to how a prudent fiduciary should begin to think and act when investing and managing other people’s money.

This directive is incorporated into all the subsequent model acts that were promulgated as a result of publication of the UPIA which is, of course, a codification of the 1992 Restatement (Third) of Trusts (Restatement). These acts include the 1997 Uniform Principal and Income Act (which, in coordination with the UPIA, helps promote prudent investment practices in the making of principal and income allocations), the 1997 Uniform Management of Public Employee Retirement Systems Act (which governs state public employee retirement plans), the 2000 Uniform Trust Code (which draws upon the common law of trusts, the Restatement and the 1959 Restatement (Second) of Trusts, as well as incorporating fully the UPIA) and the 2006 Uniform Prudent Management of Institutional Funds Act (which governs the investment and management of endowment funds of charitable institutions.

The reality, of course, is that the financial advisory profession–and its many clients–are fixated almost wholly on the return side of this fundamental, underlying trade-off. And yet, the return generated by any investment (or investment manager, financial market, etc.) is a random variable subject to inherent uncertainty. A future return, then, is unknowable today. Indeed, a return is knowable only after it has been generated and shows up in a performance track record. So most investors–aided and abetted by their advisors–focus on a variable over which they have absolutely no control.

That’s bad enough,but what about risk, the other side of the risk/return trade-off? Many, such as advisors, may speak of risk in the abstract, and some may even toss in various measurements of risk such as a standard deviation here, a Sharpe Ratio there. Still, the conversations that take place and the information conveyed almost always return to that inherently sexy subject–return–while consigning that innately boring subject–risk–to the memory hole.

Nonetheless, diversification of risk must be recognized and understood by investors. After all, in addition to risk’s central importance in the risk/return trade-off, the very first of five “principles of prudence”identified by the Restatement is that “Sound diversification is fundamental to risk management and is therefore ordinarily required of trustees.” Likewise, section 3 of the UPIA states that “A trustee shall diversify the investments of the trust unless the trustee reasonably determines that, because of special circumstances, the purposes of the trust are better served without diversifying.” Commentary to the Restatement notes that the duty to diversify risk is based on principles of Modern Portfolio Theory.In accord, the Employee Retirement Income Security Act of 1974 (ERISA) states, in part: “… [A] fiduciary shall discharge his duties with respect to a plan solely in the interest of the participants and beneficiaries … by diversifying the investments of the plan so as to minimize the risk of large losses …”

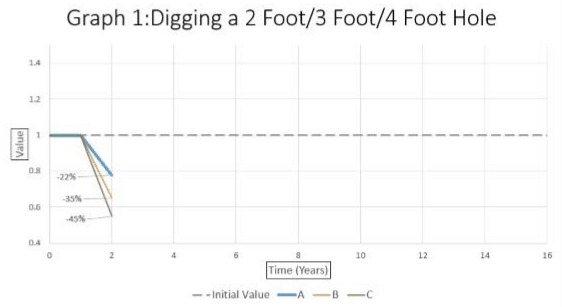

But what does “diversifying the investments of the plan so as to minimize the risk of large losses” actually mean, and how can it be achieved? Further, and perhaps more remarkably, how can portfolio return be enhanced when the portfolio is broadly and deeply diversified?Perhaps these notions can be better understood when illustrated visually. Graph 1 shows three portfolios at value 1 (any of which could be $100, $1 million, or any other amount of portfolio value) that, over a period of time during the Great Recession of 2007-2009, decreased in value by 22% (Portfolio A), 35% (Portfolio B) and 45% (Portfolio C).

Portfolio A is both broadly (across the asset class funds invested in the asset classes that comprise the world’s financial markets) and deeply (within each such asset class fund) diversified. Relative to Portfolio A, Portfolios B and C are underdiversified and experienced a larger decrease in value.

Think of the investor in Portfolio A as having dug itself into a 2-foot hole. Likewise, the investor in Portfolio B has dug itself into a 3-foot hole while the investor in Portfolio C has dug itself into a 4-foot hole. The bottom of that hole is the nadir–March 9, 2009–of the Great Recession when financial markets reached bottom. (The S&P 500 lost about 50% of its value while the Dow Jones Industrial Average lost about 54% of its value during the Great Recession, which lasted 17 months from Oct. 9, 2007, to March 9, 2009.)

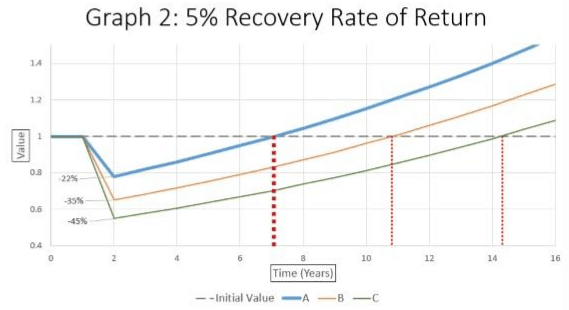

Graph 2 continues to show the respective holes in which each of the three portfolio investors found themselves. It also shows the effects of the increase in value of the three portfolios as they experience a recovery rate of return of 5%. Note the three vertical red dotted lines. Each such line indicates at what point in time a portfolio has regained its original value 1. Portfolio A (with the thicker red line) took about five years to “get back to even” while Portfolio B took a bit less than nine years and Portfolio C took a bit more than 12 years.

We can now begin to get a visual sense of how a portfolio more broadly and deeply diversified to reduce risk–that is, one in which its investor digs a shallower hole–begins the race back to its original value and arrives there much more quickly than the other two portfolios in our example that are comparatively underdiversified.

That’s not the whole story, though. After Portfolio A breaks even, it then begins to enter its growth stage (the area above the value 1 horizontal line) so that by the time Portfolio B has gotten back to even, Portfolio A has already experienced four years of growth. Likewise, Portfolio A has had a 12-year head start in growth on Portfolio C. This illustrates how a broadly and deeply diversified portfolio not only reduces risk but, in doing so, also enhances return compared to the two relatively underdiversified portfolios.

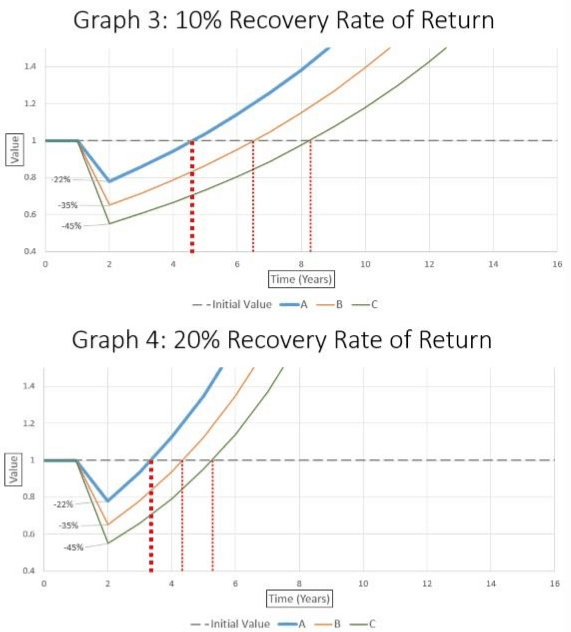

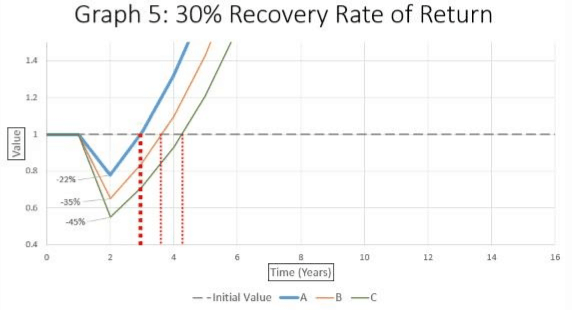

Graphs 3, 4 and 5 show how the three portfolios perform when the recovery rates of return are accelerated to 10%, 20%, and 30% respectively. As the recovery rates increase, the lines representing growth in value naturally get steeper and the years in which getting back to even at value 1 bunch up together among the three portfolios.

But note that even though the recovery rates of return increase for all three portfolios, thereby resulting in much smaller differences in the time in which the portfolios get back to even at value 1, Portfolio A continues to maintain its superiority in growth because it accelerates more quickly to the break-even mark which will give it a faster head start in accumulating, beyond value 1, more portfolio wealth.

So the moral(s) of the story include:

- Make sure to invest in a portfolio that will land you in a comparatively shallower hole as a result of the inevitable and unpredictable downturns in financial markets (which put the “R” in (bad) risk).

- Doing so not only puts you in a better position to limit the decrease in value of your portfolio, but it also gives you a head start in increasing the value of your portfolio once the equally inevitable and unpredictable upturns in financial markets occur (which put the “R” in (good) risk).

- The best way to take advantage of this double-barreled benefit–reducing risk and enhancing return–is to invest in a broadly and deeply diversified portfolio.

W. Scott Simon is an expert on the Uniform Prudent Investor Act, Restatement (Third) of Trusts and Title I of ERISA. He provides services as a consultant and expert witness on fiduciary investment issues in depositions, arbitrations and trials as well as in written opinions. Simon is the author of two books including The Prudent Investor Act: A Guide to Understanding. He is a member of the State Bar of California, a Certified Financial Planner® and an Accredited Investment Fiduciary Analyst™. Simon received the 2012 Tamar Frankel Fiduciary of the Year Award for his “contributions to advancing the vital role of the fiduciary standard to investors, capital markets and to society.” The author’s views expressed in this article do not necessarily reflect the views of Morningstar.